Acquisition project | CRED

CRED | Not everyone gets it

Picture this : you're waiting in line to enter a new club in the city that you got an exclusive invite to from a close friend you've known for years. You trust this friend with pretty much everything.

The line's moving pretty fast, people are either making it in or waiting to be let in.

The bouncers are dressed in black t-shirts with bold letters "CRIF" & "EXPERIAN"

You're wondering what it is, while they call you to step ahead & share your phone number to ID you.

Five seconds later : they say congratulations, you've made it. Your credit score is a solid 750+.

Welcome to the most rewarding payment experience there is.

Still wondering what it is?

CRED is a fintech company that was officially launched by Kunal Shah, former founder of freecharge, in the year 2018.

The initial product was built to provide users a platform to manage and pay off credit card bills and get rewarded for timely payments - AKA good financial behaviour

The marketed themselves to be a members-only app curated for the trustworthy & credit-worthy individuals of the country to make financial progress and get rewarded for good financial behaviour.

How does CRED define trustworthy & credit-worthy?

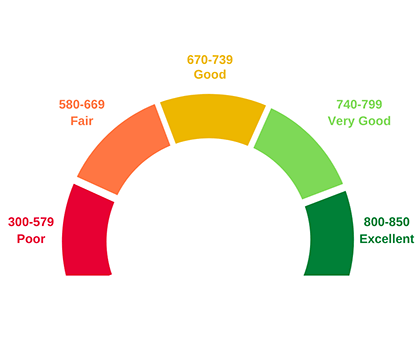

a credit score is a statistical representation of one’s creditworthiness.

CRIF, EXPERIAN, EQUIFAX are used to ensure you've practiced good financial behaviour in the past.

An individuals credit score ranges between 300-900, with 300 being the least & 900 being the most. While you can't achieve the 900 score anymore, 850 is the maximum you can get (it's like trying to get 100/100 in a language subject, they'll never give it to you)

A good credit score ranges between 670-739 & anything above that is really good.

Hence, only individuals with a really good credit score AKA 750+ get access to the club.

Today CRED has a suite of products - almost like a super app for all your payment needs & a little more:

- CRED money

- CRED mint

- CRED Garage

- CRED escapes

- CRED store

- CRED pay

- Scan & pay

- Tap & pay

- Pay anyone

- RuPay cards on UPI

Understand your Product

(Before you begin, you need to know what your product is, what are its features, what is the problem being solved by your product?)

CRED PAY

A collective of UPI payments & credit card payments across your friends, family, online orders & a lot more

Problems & solutions

- Seamless merchant integration : most apps face friction while integrating with payment methods. CRED pay does that very smoothly for large merchants online & offline with extensive tech but also for d2c brands onboarded via shopify, gokwik, shopflo etc.

- CRED pay offers rewards & incentives to the exclusive club members

- Unified payment experience with all UPI, credit card & CC on UPI transactions being done from one place.

Let’s talk UPI

<aside> 💡 Did you know that your UPI ID can be customised to your needs/ even make it funny For example : ”paymebro@hdfcbank” or "kingofcash@oksbi”

</aside>

According to NPCI (National Payments Corporation of India) there’s been a run rate of 14.4Mn transactions in the month of July’24. The transaction volume increased by a whopping 44.87% from July 2023 (9,964.61 million) to July 2024 (14,435.55 million)

From when they started in 2016 having 0.09M to just a Lakh in transactions M-O-M to 14.4Mn transactions M-O-M in 2024

Given the rapid digital adoption and innovation in payment systems, the growth could be substantial

Market leaders

- The major players in the UPI market today with txn volumes are :

- Phonepe - 6983.97 Mn txns

- Google pay - 5341.23 Mn txns

- PayTm - 1128.97 Mn txns

- CRED - 142.56 Mn txns

CRED holds a 1% market share - think it’s relevant with top 1% branding? Not really, I hope not.

- If we go deeper and split this into P2P (Peer to peer) transactions & P2M (peer to merchant) transactions source : NPCI

P2M transactions are 1.7x higher which is almost the double of P2P transactions which suggests that a large portion of UPI usage is dedicated to retail and commercial payments. This reflects

- Digital Adoption in Commerce: The widespread use of UPI for everyday purchases, from small shops to large retailers, means many consumers are comfortable using digital payments for transactions of all sizes.

- Shift Toward Cashless Transactions: The higher P2M ratio could indicate more reliance on UPI for daily expenditures, even for low-value transactions.

- Merchant Integration: With many small and large merchants now accepting UPI, consumers have more opportunities to use it, boosting P2M transactions.

TAM calculation assumptions

Broad view

- UPI Unique Users: 350 million (approximately).

- Credit Card Users: 40-50 million (4-5 crore) users.

- Total Credit Cards in Circulation: 101.8 million (10.18 crore), indicating that many users hold multiple cards.

Venn Diagram Explanation:

- Circle A (UPI Users): Represents the 350 million UPI users.

- Circle B (Credit Card Users): Represents the 40-50 million credit card users.

- Overlap: This area would represent the users who are both active UPI users and have credit cards (likely the most relevant target market for CRED).

Assumptions:

- A significant portion of credit card users is likely to be active on UPI platforms, given their tech-savvy nature.

- The exact overlap can be estimated, but even if 50% of credit card users overlap with UPI users, that’s still a substantial 20-25 million users.

ICPs - Ideal customer profile

Basis user calling exercise + one HNWI assumption : Let’s evaluate some potential ICPs & give them some personality to feel like they’re real humans 👽

High-Value Credit Card Users | Frequent Reward Seekers | Financially Savvy Millennials | Premium Lifestyle Enthusiasts (HNWIs) | |

|---|---|---|---|---|

Names | Shashank | Rishank | Sachin | Rahul |

City | Tier 1 | Tier 2/ Moved to tier 1 | Tier 2/ Moved to tier 1 | Tier 1 |

Age | 24-30 | 30-50 | 25-35 | 35-40 |

number of credit cards | 1-2 | 2-4 | 2 | 1-2 |

Income/ yearly | 15-25L | 7-15L | 10-20L | 20L+ |

Living situation | living with small - medium sized families | Living with flatmates / partner | living with small - medium sized families | living alone / with medium sized families |

Take a look at their relationship with money 🤑

High-Value Credit Card Users | Frequent Reward Seekers | Financially Savvy Millennials | Premium Lifestyle Enthusiasts (HNWIs) | |

|---|---|---|---|---|

Names | Shashank | Rishank | Sachin | Rahul |

Income | 15-25L | 7-15L | 10-20L | 20L+ |

goals | optimising rewards & utilising CC benefits, thought out investment plans | strategic about purchases, optimising & maximising rewards/ referrals | strategic spending, saving for big buys, investing for the future | premium experience, cares about lifestyle & status. Have high ROI investments across assets etc |

Personal spends | They can afford to spend quite a bit on themselves m-o-m without worrying too much. | will try to buy value added products during sales or when there are good deals/ rewards. | Informed buyers only when need arises or budgeted purchases. | Will buy as & when they see fit that improves their lifestyle, social status, rarity. |

Family / living expenses | Kids education expense Groceries / food ordersGym membership - for self & spouseOTT subscriptions Fuel m-o-m travel | Groceries / food orderstransport Social outings OTT subscriptions cult membershipQuarterly/ bi-yearly travel | Kids education expense GroceriesGym membership - for self & spouse & kids activitiesOTT subscriptions Fuel | Luxury purchasesLuxury dining experienceseducation expenses premium gym membership/ club membership OTT frequent travel |

Rent | no | yes | yes | no |

cc limits | 2L | 1L | 1-2L | 5L |

Take a look at their relationship with CRED

High-Value Credit Card Users | Frequent Reward Seekers | Financially Savvy Millennials | Premium Lifestyle Enthusiasts (HNWIs) | |

|---|---|---|---|---|

Names | Shashank | Rishank | Sachin | Rahul |

Adoption | Early adopters since CRED solved for pain point of managing multiple credit cardsuses 2+ products on CRED | came in via referral loop to optimise rewards & returnsuses 2+ products on CRED | came in via a referral, friends/ colleagues told them about benefitsuses 2-3 core features only | early adopter, uses it for exclusivity, premium UI/UXmainly for 1 core feature |

Frequency | 3-5 times a week | 5+ times a week | 3-5 times a week | once a month only for CCBP/ bills due |

appetite to pay | high | medium | medium-high | high |

reward sensitivity | medium | high | medium | low |

stickiness | likes the product & sticks to it, wants to make it one app for all things payments | might switch to a different app if there are better deals | sticks to app for core features since they installed it first | high as long as exclusivity remains |

Keeping the 5 core principles to choose our ICPs

Params | High-Value Credit Card Users | Frequent Reward Seekers | Financially Savvy Millennials | Premium Lifestyle Enthusiasts (HNWIs) |

|---|---|---|---|---|

Shashank | Rishank | Sachin | Rahul | |

Adoption curve | low - medium | low | low - medium | low |

Frequency of use case | high | high | medium | high |

Appetite to pay / spend | high | medium | medium | high |

Sizeable TAM | 6.75Mn | 12.15Mn | 15Mn | 2.87Mn |

Distribution potential | high | high | medium | niche |

Sizeable TAM calculation

With 40-50 million credit card users in India, taking the average as 45 million users. let’s split them by the above 4 categories to measure the sizeable TAM

4. Premium Lifestyle Enthusiasts

Calculations

Updated Summary

- High-Value Credit Card Users

- Percentage: 15% of credit card holders.

- Calculation: High-Value Credit Card Users = 45 million x 15% ( credit cards user x assumed % age of high value credit card users)Number: Approximately 6.75 million high-value credit card users in India.

- Frequent Reward Seekers

- Percentage: 25-30% of credit card holders.

- Calculation:Number: Approximately 12.15 million frequent reward seekers in India.

- frequent reward seekers = 45 million x 27%

- Financially Savvy Millennials

- Percentage: 35-40% of millennials interested in digital financial tool

- Calculation:Number: Approximately 15 million financially savvy millennials in India.

- financial savvy millenials = 45 million x 35%

- Number of HNWIs in India: 3.589 million (35.89 lakh).

- Number of Credit Card Holders in India: 40 to 50 million.

- Percentage of HNWIs using Credit Cards: Generally, it is reasonable to assume that a high proportion of HNWIs use credit cards. Let's estimate that around 80-90% of HNWIs use credit cards.

- Calculate the Number of HNWIs using Credit Cards:Number of HNWIs using Credit Cards = 2.8712million

- Number of HNWIs using Credit Cards= 3.589 million × 80%

- High-Value Credit Card Users: Approximately 6.75 million.

- Frequent Reward Seekers: Approximately 11.25 to 13.5 million.

- Financially Savvy Millennials: Approximately 120 to 160 million.

- Premium Lifestyle Enthusiasts: Approximately 162,500.

We’ll be picking Shashank & Sachin as our ICPs - who fall under High value credit card users & financial savvy millennials & since they use their credit cards, they’re also most likely to have adopted to using UPI as well.

Marketing pitch

<aside> 📢 Feel the odds fall in your favor! Unlock cashback, exclusive rewards from select brands & special access to curated products & experiences. Upgrade your life bit by bit

</aside>

Core value prop :

upgrade to CRED UPI & get cashback to kill your credit card bills. Every payment is rewarding

https://www.instagram.com/reel/C5GBfOxA2sU/?igsh=OG9qeXlmeHQ1ZXhl

JTBD framework to understand users motivations Current :

Job | goal | How CRED UPI Helps |

|---|---|---|

Functional | Facilitate Seamless and Efficient Payments | - Ease of Use: Simplifies payment processes with a user-friendly interface. |

- Speed: Enables instantaneous transfers and bill payments.

- Integration: Supports payments across a wide range of merchants and service providers. | | Personal | Enhance Personal Financial Management and Convenience | - Convenience: Provides a unified platform for all transactions, reducing the need for multiple apps.

- Tracking and Insights: Offers features to track spending and understand financial habits better.

- Security: Ensures secure transactions for peace of mind. | | Financial | Optimize Financial Benefits and Manage Payments Efficiently | - Rewards and Offers: Integrates with CRED’s reward system to provide benefits for UPI transactions.

- Cashback: Offers opportunities for cashback or discounts on certain payments.

- Payment Management: Helps in managing various financial obligations, multiple cards and avoiding late fees on bill payments | | social | Improve Social Interactions and Reputation | - Ease of Splitting Bills: Facilitates easy splitting of expenses with friends or family.

- Status and Exclusivity: Enhances social status due to association with CRED’s premium user base.

- Social Proof: Provides a seamless rewarding experience (get them to experience the AHA moment) that users can share, reflecting tech-savviness and financial management skills. |

Pain points with current flow

| Functional | Facilitate Seamless and Efficient Payments | Speed today is probably faster on google pay reasons :

- Gpay UI has barely changed since they began - finding the features on the app is easier & has been a standard experience throughout Since CRED is still exploring | | --- | --- | --- | | Personal & financial | Enhance Personal Financial Management and Convenience Optimize Financial Benefits and Manage Payments Efficiently | Tracking and Insights: features to track spending and understand financial habits better.

With CRED money growing + product integrations coming into play, this should definitely help user’s use case | | social | Improve Social Interactions and Reputation | Splitting bills Not a feature today since SOW with split wise users were 30% But we could look at exploring this option

Splitting bills to be used as NTC (new to CRED) funnel. |

Let’s talk about what has worked so far

Content loops

- IPL partnerships + content with cricketers / actorsHigh-Impact Advertising:

- Prime Ad Slots: utilized IPL’s high-visibility ad slots during prime match times, ensuring that CRED UPI reached millions of viewers. This prime placement helped in increasing brand recognition among a broad audience of ages 18-60.

- Creative Campaigns: CRED ran creative and memorable ads during IPL broadcasts, often featuring celebrities and humorous content, which enhanced brand recall and piqued viewer interest in CRED UPI.

Organic x content loop

- In- App campaign:For brands participating in onlyfridays : premium d2c brands - new customer acquisition on trial products Higher CAC but AHA moment experienced return purchasesFor CRED members: Exclusive rewards Products for free higher chances to win bigger JackpotsTO scale Use this to acquire users on d2c platforms by increasing their txn volumes made via CRED pay / UPI on d2c platforms & restrict coupon enablement to pay via CRED UPI to unlock the deal.

- Kill the bill campaign with streaks narrative during IPL - increased UPI adoption

- Adding some numbersNew user growth/zombie resurrection

- 2.5Mn user adoption on UPI and 1.5Mn net retained Month 1 users on UPI in 2 months

- 1Mn CRED NTUs and 1.05Mn Zombie resurrection

- Adoption: 2.4M users on UPI (~60-70% higher than monthly baseline, 2x+ during payment cycle)

- Streak completion: 40% streak completion rate

- CRED NTUs: 916k users (20% higher than baseline)

- Zombies resurrected: 1M users (20% higher than baseline)

- learnings for NTUs

- streak completion rate: completion rate has an upper limit. many users who end up doing only 1 txn don't have a use-case for SNP next day, and the recall for CRED reduces post 1st txn. need to solve for recall post adoption - majority of these users would also not return to the app next day

- Use pay online channel (CRED pay on merchant funnels) as TOFU for streaks: given the streak started without user intent, it was hard to educate the user on streak, get them to session and discover streak in-app, and build intent to use SNP/P2P (solve for this with product integrations)

- OnlyFriday’s campaign - Brand recall & solving for engagement App traffic spike week on week engagement & retention

Referrals

- Referrals via POP challenge that solves for engagement and brings your friends to CRED Referee & referred user gets a cashback on their first payment made on the appreferred users are at an average of : 55-60K referral discovery to invite (in a 30 day timespan) : is about 20-25% referral invite to sign up : 15% - 20% referral sign up to payer : 20-25% referee : 90% users claim the cashback after referring & unlocking their cashback within 7 days referred : 50% users claim the cashback after referring & unlocking their cashback within 7 days CAC : trending at Rs.350

- Some numbers month on month data

- Referral streaks : more number of people referred = unlock cashbacks by unlocking levels

pain points

- solve for discovery & visibility of referrals. Most power users said they’ve only referred users through word of mouth because they don’t know where referral is today on the app. Users assume others are using the app, since brand value exists. Add touch points & notifications when they pay their credit card bill as well (during the AHA moment) to make this better for power users.

What are some key levers that can be used to grow here :

- Product integration : Let’s look at some key places users are making P2M transactions

Dividing this into 2 large categories

- High transacting categories1. Food and Dining:These buckets simplify the list while maintaining clear distinctions between spending areas.

- Fast food restaurants & deliver

- Eating places and restaurants

- Bakeries

- Retail and Consumer Goods:

- Department stores

- Drug stores and pharmacies

- Digital goods: Games

- Telecommunication and Utilities:

- Telecommunication services (local and long distance calls, credit card calls)

- Utilities (electric, gas, water, and sanitary)

- Fuel and Transportation:

- Service stations (with or without ancillary services)

- Medium transacting categories

- Beverages and Grocery Shops:

- Dairies

- Drinking places (bars, taverns, nightclubs, cocktail lounges)

- Candy, nut, and confectionery shops

- Package shops (beer, wine, and liquor)

- Cigar shops and stands

- Financial and Brokerage Services:

- Debt collection agencies

- Securities brokers and dealers

- Niche Markets and Repair Services:

- Online marketplaces

- Electronics repair shops

- Freezer and locker meat provisioners

With CRED UPI / CRED pay via credit card being present on almost all high transacting categories introducing the split feature here would increase users adoption of the p2p/ scan and pay feature on CRED. Imagine this : for a particular large bulk order on Swiggy/ dining order and pays for the entire order. Your friend is a CRED user that used CRED to pay for this order The offer call-out on merchant funnel’s checkout : “split the bill with your friends & earn upto cashback. use it to reduce your credit card bill”

once the payment is completed show a split option using contact’s allow CRED user to send these folks a request for Rs.x & a notification to the friend’s device PN - if existing user Whatsapp comm - if new user, zombie that’s uninstalled the app

After the meal, the friends use CRED’s UPI feature to transfer the share of each friend’s portion to the person who paid & all users earn cashback while doing the same.

These user then use their cashback the next time they pay off their cc bill - bringing them back to the core product loop.

Cashbacks can be determined by user type definition : New to CRED user : higher cashback New to CRED pay : medium cashback Existing active user : low cashback Zombie user : higher cashback

Also acts as referral loop for new users

Core Value Proposition & user lifecycle

Making payment experiences rewards because who likes to know money is leaving their bank account without getting rewarded for good behaviour.

Understanding the Users

(Go and speak to different users of the product and the people in the chain: households buying the product, shopkeeper selling the product, churned users, users using competitors products. In case of B2B products identify the decision makers, the influencer, blocker and the end user)

Type of users :

Power user :

- uses more than 3 features on the CRED app.

- uses it atleast 3 times a week

- recommended the app to friends & family

- tries out new features on the app

Active user :

- uses app specifically for 1-2 core features

- uses the app 1-2 times a month

- recommends the app

Zombie :

- used the app for a while and now hasn't come back for more than 60 days

- potentially wouldn't come back

New user :

- never used CRED before

Name of the user | Type of user | Objective | what'd you learn |

|---|---|---|---|

Power user | Why is he a power user? | user found out about CRED through a friend when he got his 2nd card to manage his credit card bill payments on one app | |

| New user | Do they have a credit card? | User doesn't have any credit card to manage personally so doesn't understand the appeal. |

| Power user | Why is he a power user? | |

| power user | Why is he a power user? | Doesn't trust other apps, stopped trusting paytm |

| | | |

Understanding your ICP

(There are separate tables for both B2C and B2B products, put down your your ICP’s in a Table Format, use this as a reference.

This table makes it super clear for anyone to understand who your users are and what differentiates them)

- B2C Table - influencers

Criteria | User 1 | User 2 | User 3 | User 4 |

|---|---|---|---|---|

Name | Rachana | Ganesh | | |

Age range | 25-34 | 35-40 | ||

Demographics | Tier 1 city | Tier 1 city | ||

(refer the table below) | | | ||

Pain point | An app to help pay off credit card bills easily. New to the system | one app for all online payments | ||

Solution | onboards onto CRED heard on social media | uses CRED for the first time . Recommended by colleagues | ||

Behaviour | frequent credit card & UPI user. | user is a multi credit card holder.

| ||

(refer the table below) | | | ||

Perceived Value of Brand | convenient | convenient | ||

Marketing Pitch | | |||

Goals | fast & secure, rewarding | fast & secure, rewarding | ||

Frequency of use case | daily, weekly, monthly | weekly, monthly | ||

Average Spend on the product | 40K - 80k CC + UPI spends | 75k-1.5L CC + UPI spends (across cards) | ||

Value Accessibility to product | | | ||

Note: This is not an exhaustive list, you know your product better, add/remove as per the context! | |

Criteria | ICP 1 | ICP 2 |

|---|---|---|

Adoption Curve | High | High |

Appetite to Pay | Medium | High |

Frequency of Use Case | High | Medium |

Distribution Potential | High | medium/ low |

TAM | |

Understanding the Market

(begin by doing a basic competitor analysis)

Factors | Competitor 1 | Competitor 2 | Competitor 3 |

|---|---|---|---|

What is the core problem being solved by them? | PhonePe | Google pay | Paytm |

What are hey features/services being offered? | Leading digital payment platform solving for - All things payments (cc bills, UPI, recharges, rent & more) | All things payments (cc bills, UPI, recharges, rent & more) | All things payments (cc bills, UPI, recharges, rent & more) |

Who are the users? | | | |

GTM Strategy | | ||

What channels do they use? | | ||

What pricing model do they operate on? | | ||

How have they raised funding? | | ||

Brand Positioning | | ||

UX Evaluation | | ||

What is your product’s Right to Win? | | ||

What can you learn from them? | |

(then try to understand the market at a macro level and evaluate the trends and tailwinds/headwinds.)

Now it’s time for some math, calculate the size of your market.

TAM = Total no. of potential customers x Average Revenue Per Customer (ARPU)

SAM = TAM x Target Market Segment (percentage of the total market)

SOM = SAM x Market Penetration/Share

Designing Acquisition Channel

(keep in mind the stage of your company before choosing your channels for acquisition.)

Channel Name | Cost | Flexibility | Effort | Speed | Scale | Budget |

|---|---|---|---|---|---|---|

Organic | | |||||

Paid Ads | ||||||

Referral Program | ||||||

Product Integration | ||||||

Content Loops | |

Detailing your Acquisition Channel

Organic Channel

(Understand the existing organic channel strategy for your product and highlight the success and failure thereon.

Provide your suggestions and devise new strategies.)

Step 1 → Conduct keyword research on Google, Amazon, Youtube, Quora etc.

Step 2 → Collate all your insights from all your searches.

Content Loop

(Keep it simple and get the basics right)

Step 1 → Nail down your content creator, content distributor and your channel of distribution

Step 2 → Decide which type of loop you want to build out.

Step 3 → Create a simple flow diagram to represent the content loop.

Paid Ads

(Understand what is already being done, what is working out well and what needs to be stopped)

Step 1 →Define the CAC: LTV ratio. If your product has a healthy CAC:LTV ratio, proceed with paid ads.

Step 2 → What digital channels will you work with?

Step 3 → What will be your audience selection & creative strategy? (What you build in ideal customer profile should reflect here)

Step 4→ Design the Ad Campaign

Step 5 → Frame the Ad Budget

Product Integration

(Understand, where does organic intent for your product begin?)

Step 1 → Understand does your product fit in?

Step 2 →Draw a possible flow of how the product will look like inside the integration.

Step 3 → Create a plan of multiple integrations that you could do.

Referral Program/Partner Program

(For B2B companies, if referral does not make sense you'll take a crack at a partner program for your product)

Step 1 → Flesh out the referral/partner program

Step 2 → Draw raw frames on a piece of paper to get the gist.

(Don't spend a lot of time on design. This is for you to communicate how the referral hook will look)

we hope this helped you break the cold start problem!

Reminder: This is not the only format to follow, feel free to edit it as you wish!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.